what is the salt deduction repeal

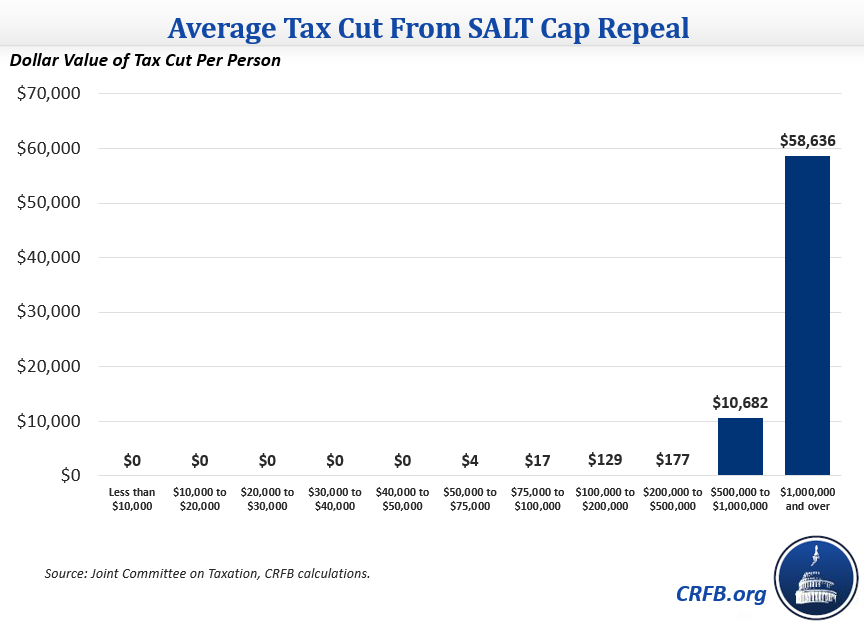

It allows those with the most expensive mortgages and by extension the highest incomes to deduct the most reducing their federal taxes by much more. The SALT deduction tends to benefit.

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

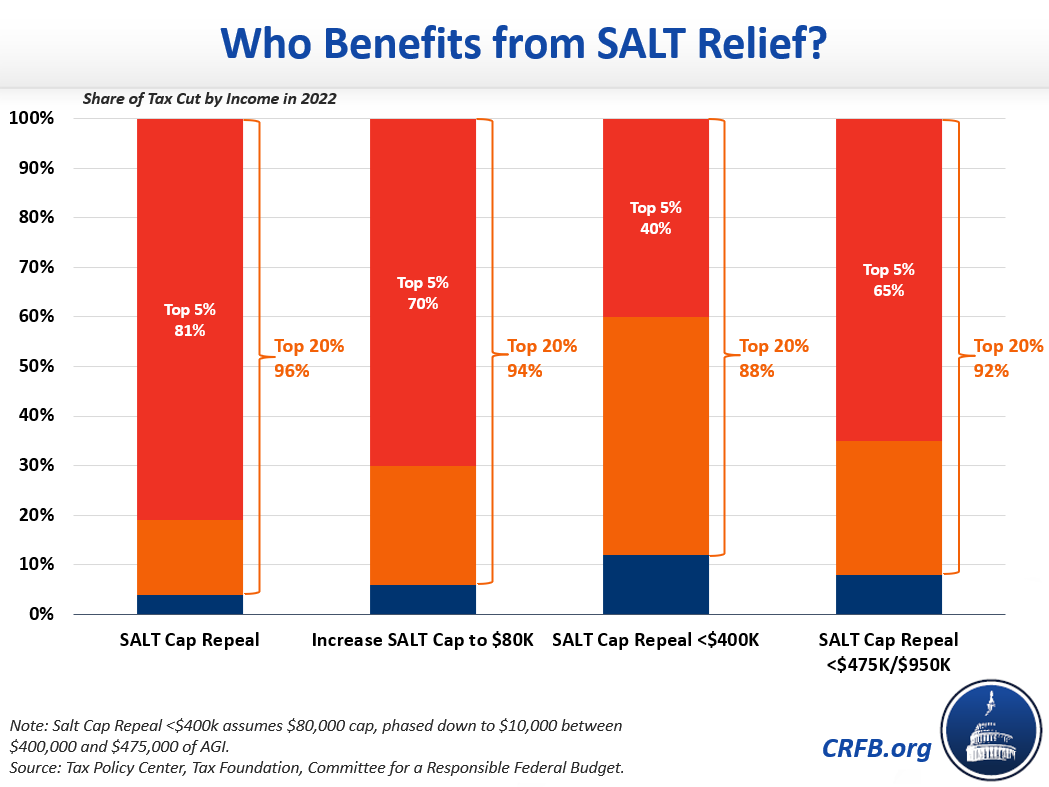

Policymakers are considering other options to reform or repeal the SALT deduction cap.

. The repeal of the cap is estimated to result in a decrease in tax liability for 131 million taxpayers 94 percent of which have 100000 or more of economic. March 1 2022 600 AM 5 min read. Tax Policy Center.

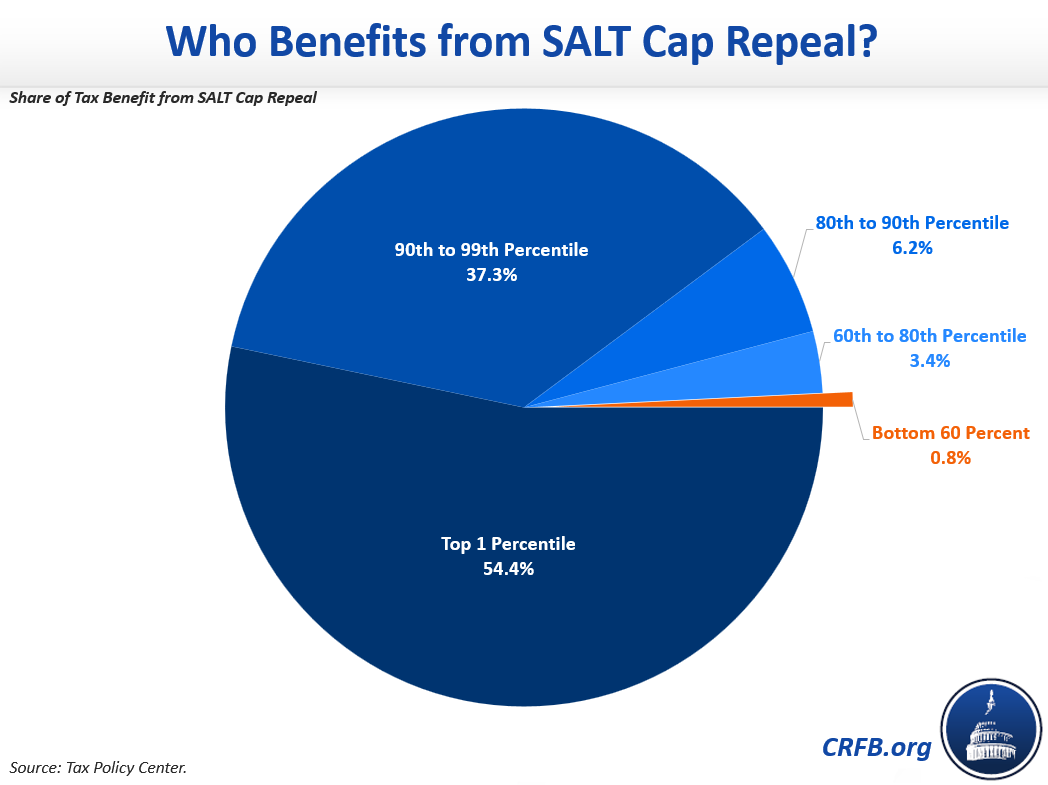

For your 2021 taxes which youll file in 2022 you can only itemize when your individual deductions are worth more than the 2021 standard deduction of 12550 for single filers 25100 for joint filers and 18800 for heads of household. Only about 9 percent of households would benefit from repeal of the Tax Cuts and Jobs Acts TCJA 10000 cap on the state and local property tax SALT deduction and more than 96 percent of the tax cut would go to the highest-income 20 percent of households. The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to.

The lawmakers have asked the US. The Tax Cuts and Jobs Act TCJA capped it at 10000 per year consisting of property taxes plus state income or sales taxes but not both. The SALT deduction tends to benefit states with many higher-earners and higher state taxes Joint Committee on Taxation.

A new bill seeks to repeal the 10000 cap on state and local tax deductions. 52 rows The SALT deduction is only available if you itemize your deductions using Schedule A. President Donald Trumps 2017 tax reform capped the SALT deduction at 10000.

Capitol on April 15 2021. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes.

A growing rift among Democrats over whether to repeal a Trump-era limit on state and local tax deductions is threatening to derail President Biden. What is the salt deduction repeal. Biden is less enthusiastic about a SALT cap repeal than some members of the New York and New.

If Congress decides to remove the cap on SALT. The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize their deductions. A group of House Democrats pushing to lift the SALT cap most of them from New York and New Jersey insisted Wednesday the deduction is progressive and that the 10000 cap created in the 2017.

Calls to end the 10000 cap on state and. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. The SALT deduction when no cap is in place is a highly regressive tax policy meaning its benefits go to the wealthiest taxpayers who regularly write off over 10000 on their taxes.

Senator Joe Manchin the West Virginia Democrat at the center of negotiations over an economic-policy bill said he opposes changes to the state and local tax deduction dealing a blow to House. Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent increase in after-tax income for the top 1 percent and 1 percent decrease for the 95 th to 99 th percentiles. For example the 10000 SALT cap could be doubled for joint fillers who currently face a marriage penalty.

Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. Tom Suozzi D-NY speaks during a news conference announcing the State and Local Taxes SALT Caucus outside the US. Americans who rely on the state and local tax SALT deduction at tax time may.

2 days agoThe hope for a repeal on the cap on federal deductions for state and local taxes - known as SALT - took a hit as the climate change deal jelled. Restoring it i. Who benefits from the SALT deduction.

The prior-law AMT affected households earning between 200000. Two single filers may each take up to 10000 in SALT deductions but jointly filing means only one 10000 deduction can be taken. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

SALT Cap Repeal Below 500k Still Costly and Regressive Nov 19 2021 Taxes According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less.

State And Local Tax Salt Deduction Salt Deduction Taxedu

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Why Repealing The State And Local Tax Deduction Is So Hard

Salt Deduction Resources Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget